Formula 1 has long been a world-touring spectacle, but its financial velocity has now caught up with the speed on the track. The result? Team valuations have exploded, with Ferrari's prancing horse leading the charge.

What most sports achieve with a single championship event each year, F1 repeats 24 times – every race weekend pulling in massive crowds and global broadcast audiences, transforming the sport into a worldwide premier entertainment property.

This shift is no accident. Since Liberty Media took control in 2017, F1 has masterfully broadened its appeal while maintaining its exclusive aura, creating the exact financial environment investors crave: global reach, limited supply of teams, and capped costs that create predictable profits.

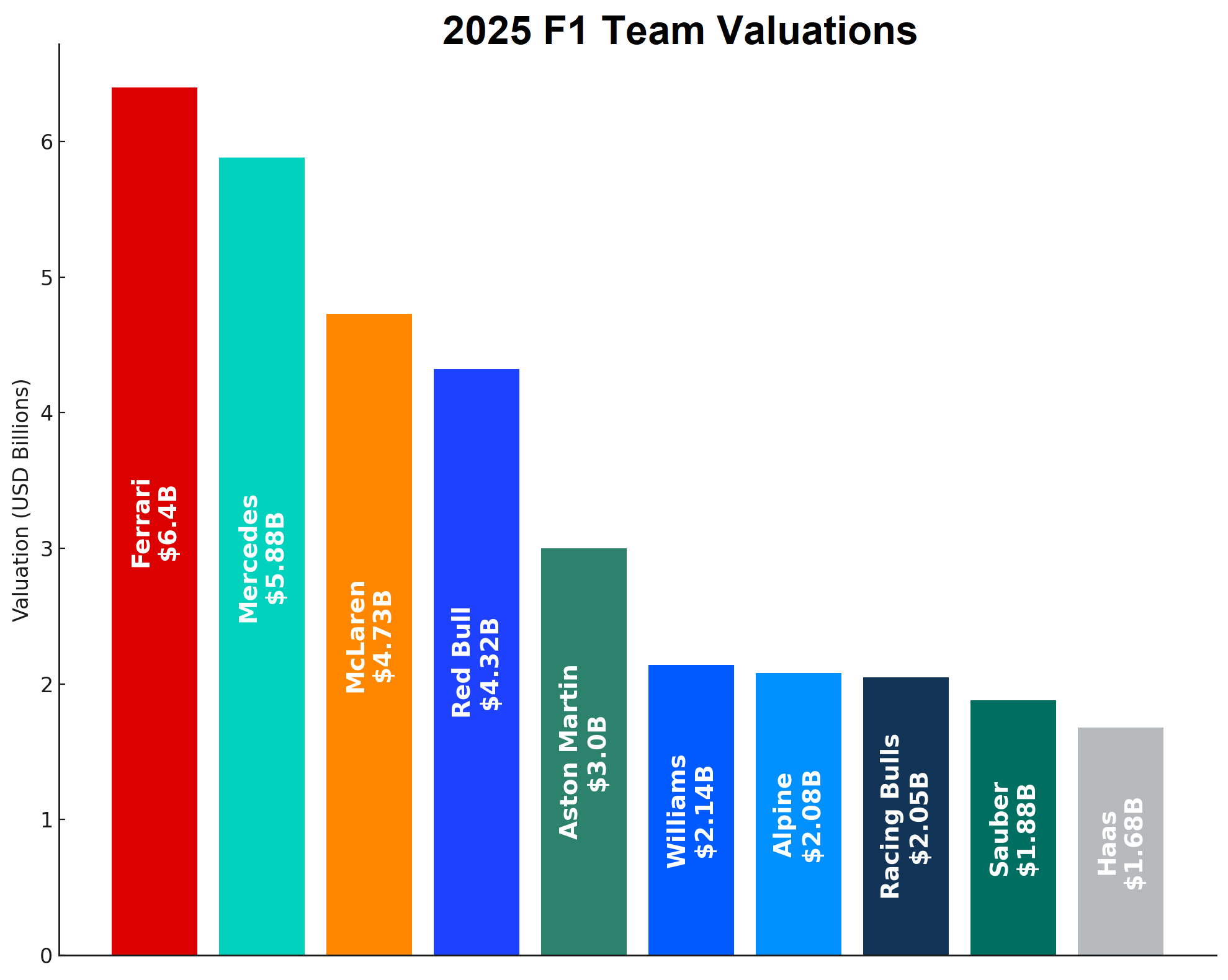

This year, Formula 1’s 10 teams on the 2025 grid average an estimated $3.42 billion in value, a remarkable 48% year-over-year leap, and more than double their worth in 2023 according to sports business website Sportico.

Closing In on the NBA and the NFL

Those numbers now put F1 teams ahead of MLB franchises in the United States and just behind the NBA and the NFL among the world’s most valuable sporting assets. And the gold rush is showing no signs of slowing down.

"The 10 teams shared total prize money payments of $1.27 billion in 2024, up from $1.22 billion the prior year," Sportico reported.

"The distributions consider the previous year finish by teams on the track in the Constructor standings, as well as the current year revenue of Formula 1. Title-winning teams and teams that finished in the top three over the past decade are eligible for additional payments.

“Ferrari gets an additional bonus that runs into the tens of millions of dollars because of its historical standing in the sport."

Ferrari Still F1’s Crown Jewel

Ferrari remains Formula 1’s most valuable team at $6.4 billion, ahead of Mercedes at $5.88 billion and a rapidly ascending McLaren whose valuation $4.73 billion valuation has skyrocketed by 203 per cent in two years – the biggest surge on the grid

Red Bull, valued at $4.32 billion, has slipped behind McLaren. While its growth remains substantial at 79 per cent, it hasn’t kept the pace relative to its front-running rivals.

Aston Martin completes the top five at $3 billion, buoyed by owner Lawrence Stroll’s aggressive drive for new investment through partners such as Arctos and HPS.

In the densely packed mid-field, Williams, acquired for roughly $200 million in 2020 by Dorilton Capital is now worth 10 times that at $2.14 billion, while Alpine ($2.08 billion) and Racing Bulls ($2.05 billion) also clear the US$2 billion mark. The latter even reportedly turned down an offer in that range earlier this year, according to Sportico, highlighting surging demand.

Ahead of their rebrand as Audi, Sauber sits at US$1.88 billion following fresh backing from Qatar’s sovereign wealth fund, while Haas rounds out the grid at US$1.68 billion – a figure that would have ranked among the sport’s elite only a year ago.

Why Everyone Wants a Piece of the Paddock

Scarcity is a powerful economic engine in sports, and in F1 it’s practically a turbocharger. Only 10 teams exist – 11 when Cadillac enters in 2026 – and control sales remain rare. Even so, nearly every team is receiving weekly investment offers.

The market’s confidence is bolstered by predictable cost structures thanks to the sport’s budget cap, a booming global fan base of 827 million, and blockbuster broadcast deals like Apple’s $750 million agreement starting in 2026. Add in the sport’s growing youth and female demographics, and the sponsorship potential is enormous.

Formula 1 may no longer simply be motorsport – it’s becoming one of the world’s most desirable assets, and investors are racing to the paddock faster than ever.

Read also: Wolff in talks to sell slice of Mercedes F1 stake at record valuation

Keep up to date with all the F1 news via X and Facebook